Recent workforce adjustments across MNOs, RAN OEMs and major tech companies highlight a transformative period in the telecom and technology sectors. These changes reflect a strategic recalibration as the industry navigates the evolving landscape of 5G RAN Cloudification. While the adoption of 5G Cloudification RAN use cases and private networks is still in its early stages (Reference: Poll), this phase presents a unique opportunity for innovation and growth.

Private 5G Networks, MORAN, Open RAN, Cloud RAN, and advanced 5G in-building solutions are emerging as pivotal components in enhancing connectivity and operational efficiency. Although these technologies are in a developmental phase, their interconnected nature means that advancements in one area often drive progress in others.

In this article, we will examine the current status of Open RAN (ORAN) and its impact on in-building and private network landscapes. As the industry evolves and integrates these advanced technologies, there are exciting opportunities on the horizon for both MNO subscribers and enterprise customers.

After dedicating several weeks to attending industry sessions, I’ve gathered key insights to share with you in this article. Grab a coffee, stay focused, and make sure you’re ready to dive in ORAN Architecture

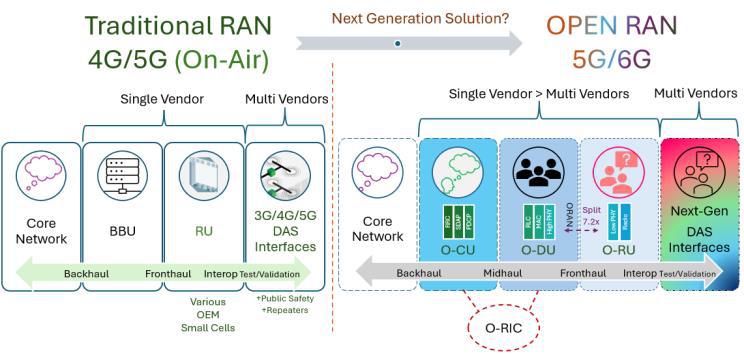

Traditional RAN 4G/5G (ON-AIR)

To Next Generation Solution!

Open RAN 5G/6G

Envisioning OPEN RAN 7.2x with E2E hardware/software vendors – Drawing by Bijoy Gajjar

The left picture shows a Traditional RAN system, which uses a single OEM’s hardware for all network functions, including radio processing, baseband processing, and network control, with proprietary protocols. This mature setup means that all components, such as OSS software, baseband hardware, and remote unit hardware, come from one turnkey solution provider. Currently, all solutions are on-air including legacy DAS, Repeater, Public Safety, 3G, 4G, 5G Inbuilding Solutions over this architecture when we look at US Tier 1 MNOs.

Right side, Open RAN (O-RAN) introduces a more flexible approach by separating these functions into distinct layers for specific use-cases. Goal of such split is to minimize cost and open innovation. For instance, the O-RU (Radio Unit) handles the lower physical layer processing, the O-DU (Distributed Unit) manages baseband processing and other controls, the O-CU (Central Unit) oversees packet data protocols, and the O-RIC (Intelligent Controller) optimizes network performance through data analysis, paving the way for future AI/ML advancements. ORAN 7.2x Split will enable coverage and capacity solutions for indoor, high traffic urban situations. This could open many new innovations and solutions that might boost the economy with new revenue streams if successful. While this article doesn’t cover business use-cases, it focuses on the current structure and roadmap challenges for O-RAN.

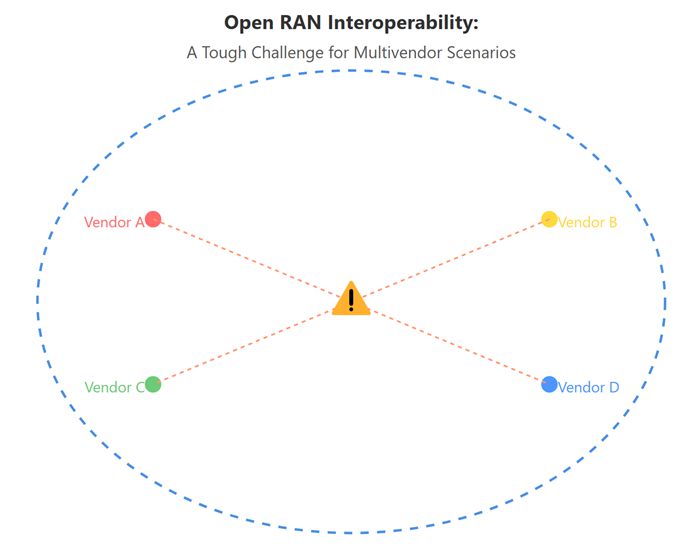

ORAN Interoperability and Disaggregation

While horizontal disaggregation (CU-DU-RU) continues to make progress in single OEM configurations, achieving multivendor solutions alongside vertical disaggregation will be a long road, requiring extensive testing and validation. Chipset manufacturer, for instance, is currently involved in DU and RU disaggregation in Proof of Concept (PoC) stages. Certain features, like NB-IoT configurations, were missing, during the learnings of validation, creating significant dependencies for UK based Operator as they generate a lot of revenue on that stream.

Different vendors come with varying baselines, adding complexity. Although engagement in the ecosystem is positive, progress will be incremental.

Envisioning ORAN with global cross-functional HW/SW Vendors – Created by Bijoy Gajjar (Gen AI)

As shown in the picture above, the small electronics rely heavily on various software, firmware, and APIs to create a seamless user interface experience. Achieving this in Open RAN requires continuous collaboration among multiple teams, working around the clock. The more vendors involved in the hardware and software, the greater the complexity.

Simple illustration of Working Groups with MNO & Customer Success at the Center – Drawing by Bijoy Gajjar

Multivendor Integration: A Long-Term Goal

Achieving multivendor compatibility remains a long-term goal, starting with single-vendor systems that will gradually open through disaggregation of (RU-DU-CU) and matures with resolution of significant red-flag and orange-flag risks. After the lab, suburban areas present small market opportunities for this approach. Though the core of many networks, for example One of Tier 2 US MNO, already supports multivendor environments, collaboration between vendors is still one of the most difficult aspects of successful Open Radio Access Network deployment.

Vendor Collaboration and Synchronization

Envisioning a Global Team of Diverse Stakeholders in ORAN – Created by Bijoy Gajjar (Gen AI)

Even when two vendors are integrated, their product roadmaps, lifecycle, and software releases must align for successful operations. This synchronization is time-consuming but necessary to ensure a positive outcome for the end customer. Success in ORAN requires innovation, transparency, and close collaboration within the ecosystem. Conflicts between OEMs/Stakeholders should be avoided. By fostering cooperation, ORAN can make progress.

The Short-Term Goal

Horizontal Disaggregation & Security

The overarching goal is to achieve horizontal disaggregation in RAN first, then move toward vertical disaggregation with multivendor integration. Security remains a top priority across all OSI or TCP/IP layers, particularly with cloud configurations, which can be vulnerable. Open RAN’s disaggregated architecture increases the attack surface, especially at the interfaces between multi-vendor technologies. MNOs must address evolving threats related to open-source applications, 5G network functions, and interfaces with developing standards. Security for cloud infrastructure, virtualization, containerization, and protection against DDoS attacks also require attention. In 2024, one notable issue involved a cybersecurity breach affecting Delta Air Lines, Microsoft, and CrowdStrike. I am not security expert but clear guidelines will be critical.

Brownfield vs. Greenfield Deployments

While greenfield deployments are ideal, most Open RAN trials are currently conducted in brownfield environments, where disaggregated interfaces are first tested in the lab and then introduced in low-priority markets. Greenfield scenarios remain impractical at this stage.

Outdoor & Indoor Scenario with Greenfield vs Brownfield – Created by Bijoy Gajjar (Gen AI)

Think of it as conducting live surgical procedures on a 5G network, where each customer centric solution phase involves carefully planned implementations for both outdoor and indoor solutions. Each deployment cluster is meticulously monitored and scaled gradually over an extended observation period.

The success of specific configurations will ultimately be judged by the customer experience, as the customer’s satisfaction is the true measure of success.

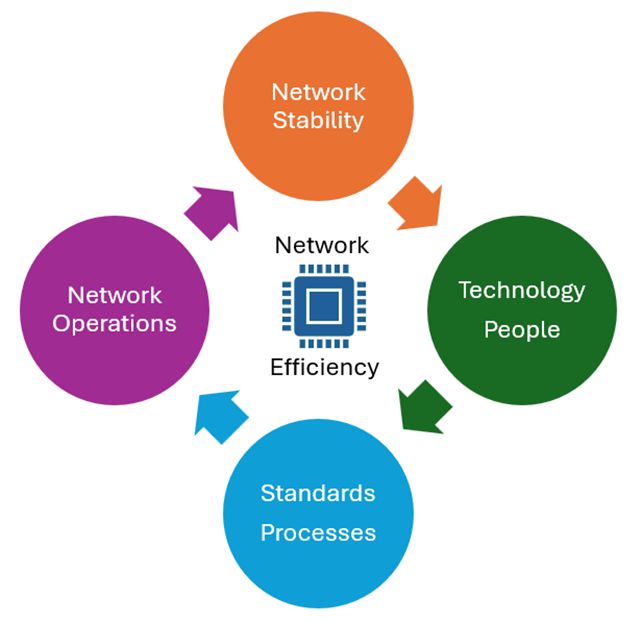

Operational Stability and Vendor Coordination

Network Operations during this transition period will rely heavily on strong vendor collaboration. Seamless software and hardware upgrades, along with maintaining harmony between participating vendors, are essential to avoid disruptions. Vendors must set aside competitive differences and work cohesively to ensure success on the path to 6G. An efficiently operating network is critical—without it, no configuration or solution can truly meet customer needs.

ORAN Configurations – Network Efficiency | AI ML Integration O-RIC to 6G – Drawing by Bijoy Gajjar

The MNO will expect smooth, seamless operation with no significant issues on a daily, weekly, or monthly basis. It’s not just about design and deployment; smooth operations, automation, and ongoing maintenance must be tightly aligned with key performance indicators (KPIs) to ensure long-term success

Cloud Considerations: Private vs. Public

In-house Server vs Public Cloud Data Center Server – Photo Source: Internet

Private cloud is likely the first step in most deployments due to security concerns, especially for MNOs. Public cloud offers cost efficiency and better GPU support, but it may be less trusted for mission-critical operations. A hybrid approach could add complexity, as software versions may differ between private and public clouds. Typically, a MNO or large private network operator expects to test new software features or updates in a smaller environment or cluster before rolling them out nationally or throughout their network. A private cloud server allows this pathway, as you cannot control the public cloud, which is shared among a number of different customers with varying needs.

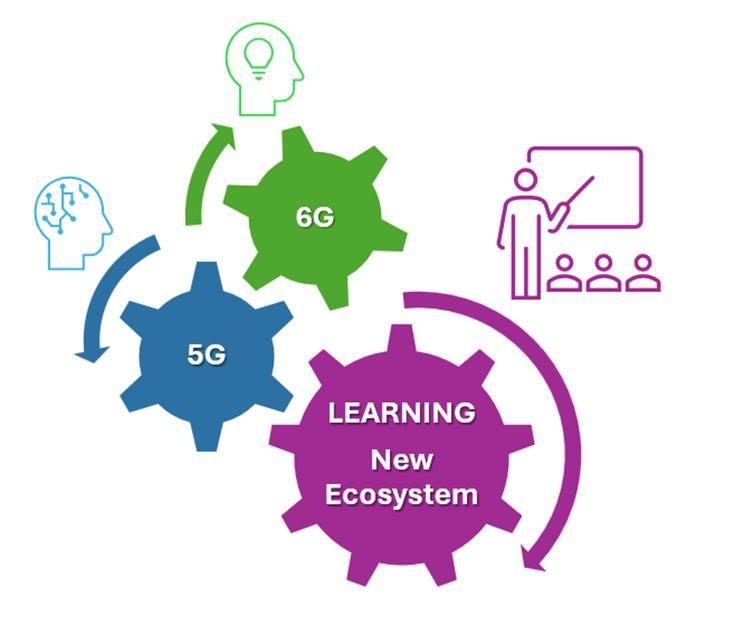

Path Forward: Training and Adaptation

Ongoing Learning: Exploring 5G Monetization and Emerging 6G Innovations – Diagram by Bijoy Gajjar

Live training and continuous learning are essential as the industry progresses through new technology trials. Global picture in mind, service providers are already adapting to ORAN trials, while others remain reluctant. Engineering teams will require a lot of dedicated trainings and learning hours to shift to new ecosystem and without MNO planning, ORAN will be hard to achieve.

In several global markets, some vendors have lost contracts due to the challenges and complexities involved in participating in ORAN trials. Currently, more than 300 vendors are involved in the ORAN ecosystem (hardware software). However, if ORAN is the path industry takes, once horizontal disaggregation becomes standard over the next five years, smaller players are likely to merge with larger entities. Success in this evolving landscape will depend on vendors’ ability to align their roadmaps with partners and service providers, effectively addressing software releases, features, and interoperability challenges. Not all vendors may endure; consolidation is anticipated.

AI In RAN

Open RAN is expected to greatly benefit from automation and self-optimization, driven by advancements in AI and machine learning (ML). These technologies promise to enhance network efficiency, performance, and adaptability. Significant progress is expected over the next years as challenges in scalability, interoperability, and real-time decision-making are addressed. This topic warrants a separate discussion as it goes into O-RIC deep-dive and could form the basis for a new article.

Lifecycle, Cost of Integration and Management

Unfortunately, Open RAN was introduced alongside 5G, which has posed difficulties. The demand for automation and a “killer app” hasn’t materialized yet. For MNOs who haven’t deployed ORAN on a large scale, the question arises: Why shift to a new model when 5G effectively meets current customer needs?

While future developments like smart cities, smart manufacturing, and private 5G networks may eventually drive demand, the economic climate has slowed progress. Open RAN is likely to gain traction with the advent of 6G. Meanwhile, 5G single-vendor networks are accruing financial commitments that need to be managed through continued monetization efforts before MNOs can transition to next-generation solutions.

The integration of new technology and vendor management remains a challenge. The cost of these solutions, coupled with their 5-7 year lifecycle, must be carefully considered. Although the outlook for Open RAN is positive, addressing issues related to cost, efficiency, and long-term lifecycle planning is essential.

Customer-Centric Solutions & Total Cost of Ownership (TCO)

Visual of TCO Unknown Cost in ORAN Model – Visualization Creation by Bijoy Gajjar

Customer-centricity is key. It’s not enough to innovate for technology’s sake; solutions must align with what customers want. The Total Cost of Ownership (TCO) is a critical factor. Vendors will need to collaborate with multiple teams to address these challenges, and initial vendor participation may be limited to a small group of active players who are engaged with MNOs, customers, and technology groups.

In the simple gear-box diagram above, imagine the areas without dollar “$” signs on the ‘helical gears’— unknown on Day 1 after GA of ORAN Configuration but still essential for driving ORAN development based on the roadmap findings. Since Open RAN technology is still evolving, achieving a definitive “Total Cost of Ownership (TCO)” is challenging. Even after deployment, it remains uncertain which use cases will require further refinement due to ongoing hardware, software, feature, and roadmap developments. TCO analysis will be a gradual process, with results varying based on specific use cases and configurations. Essentially, it’s a journey of discovery—organizations will gain insights, add more $ as needed into any breaks to move it forward.

CAPEX/OPEX Savings with ORAN

Currently, it is challenging to assess potential savings due to the lack of clarity around the Total Cost of Ownership (TCO) at this stage.

Current Focus: Interoperability and Testing

The current focus is on achieving interoperability and conducting thorough testing to ensure the long-term viability of Open RAN solutions. In conclusion, while Open RAN offers an optimistic future, significant challenges remain, particularly around interoperability, vendor collaboration, and the cost of integration. However, with an absolute positive approach, transparency, cooperation, and a customer-focused vision, these obstacles can be overcome as the industry moves toward a fully disaggregated RAN ecosystem.

In-Building Solutions: The Current Landscape for Venues and Enterprise Spaces

Emerging Technology awaiting Strategy & Capital for Inbuilding Upgrades – Created by Bijoy Gajjar (Gen AI)

As highlighted in my Connect-X 2024 article, “How Industry Leaders View Nextgen Inbuilding Systems,” inbuilding solutions faced challenges due to conflicting strategies among U.S. Tier-1 MNOs.

As noted at the beginning of the article, there are interconnections between O-RAN, 5G, and 6G. While the 3GPP sets the roadmap for 5G and 6G, and the O-RAN Alliance leads O-RAN standardization, convergence is likely where

private networks, 6G, and O-RAN intersect. This convergence could lead to the creation of advanced wireless solutions.

Currently, numerous subgroups are dedicated to helping validate interoperability between O-RAN participating OEMs. The In-building Small Cell Subgroup is part of this effort. These leaders aim to leverage insights from MNO use cases and synchronize vendor teams to transform each requirement into a success story through comprehensive validation plans for O-RAN.

US Tier 1 MNOs – ORAN Adaption

Dish Network is currently the only 5G ORAN network in the U.S., positioning them ahead in the ORAN landscape. U.S. Tier 1 MNOs have recently actively participated in working groups advancing the ORAN vision through technology validation efforts.

However, since these large Tier 1 MNOs likely focus on monetizing their existing 5G infrastructure and seeking cost-effective revenue opportunities, this approach may lead to more affordable in-building solutions.

Simultaneously, enterprises are expected to increasingly adopt 5G private wireless use cases, particularly with recent improvements in CBRS Spectrum policy by the FCC.

Neutral Host Networks (Private/Public) could potentially unlock new business opportunities and create innovative verticals in public venues and enterprise in-building spaces. For example, Private Network End User Devices or AR/VR headsets connected to an Open RAN RU, DU, and CU architecture hosted in a Public Cloud Network Edge Data Center, with Amazon AWS/Microsoft Azure/Google Cloud running applications programming interface tailored to various use cases.

Distance Learning via Private 5G – Professor in USA, Global Virtual Class – Created by Bijoy Gajjar (Gen AI)

Achieving full ORAN interoperability among various in-building OEMs will be complex, especially with 6G commercialization expected in the next 6 to 8 years (2030–2032). However, the integration of AI in RAN will be pivotal to 6G’s success, positioning ORAN as a key enabler in the evolution of advanced wireless technologies.

Use Cases – Smart City – Created by Bijoy Gajjar (Gen AI)

Looking ahead, OEMs currently engaged in in-building solutions that have established relationships with large MNOs and are active in the current stage of ORAN interoperability are likely to integrate into larger ecosystems and benefit from enhanced collaboration. Smaller vendors may still find success if they secure sufficient industry support.

Inbuilding Private Networks – Recent Learnings

The Manufacturing sector and Education industry have seen the highest growth in recent quarters when considering inbuilding private 5G solutions.

However, the development of private network spectrum End User Devices faces a ‘chicken and egg’ dilemma: device manufacturers need a deployed network to showcase scalable use cases, while 5G network deployment teams expect devices to be available before rolling out the network. Europe leads in private network deployments with 47%, followed by the US with about 20% through CBRS, and the rest of the world, including Asia-pacific, Latin America and Caribbean (excluding China).

Private Network implemented in Auto Manufacturing Plant – Created by Bijoy Gajjar (Gen AI)

China primarily relies on public network spectrum to provide private network services. In North America, a similar approach has proven successful with BRS and C-Band spectrum, where MNOs have provided private 5G solutions using their licensed public network spectrum.

NVIDIA Inbuilding ORAN Initiative

During the 2nd quarter of 2024, NVIDIA in the U.S. Campus began trialing Private Network Initiative validations using the 3.7GHz to 3.8GHz spectrum, which aligns well with the private network frequencies used in several European countries (Reference Post).

These validation efforts could support the scalability of global private network initiatives and help standardize solutions for RAN OEMs and device manufacturers as we move towards 6G and/or ORAN.

Envision Private Network End-User Device Manufacturing Plant – Created by Bijoy Gajjar (Gen AI)

Notably, the FCC’s updated guidelines for the U.S. CBRS spectrum were released after this initiative. It will be interesting to see if a major player like NVIDIA will incorporate CBRS private network validations in the near future.

Given that NVIDIA is a leader in GPU technology, AI/ML, cloud computing, and data centers, their advancements could significantly impact the chipset market, drive innovation in cellular devices, and play a major role in the infrastructure for next-generation wireless networks.

Inbuilding Capacity Dimensioning & Ease of Operations

Capacity dimensioning for in-building networks is a critical factor in ensuring efficient and scalable network performance. Over-dimensioning RAN sources in Public Venue or an Enterprise design can generate excessive amounts of data, which may not contribute meaningfully to next-gen RAN Intelligent Controller (RIC) AI/ML

automation. Streamlined RF data management, cell planning, and alignment between design and deployment, coupled with detailed labeling of as-built configurations, play a key role in facilitating automation. If any RAN resource triggers an alarm, it can immediately flag issues for MNO operations, affecting overall network performance.

Operations Engineer troubleshooting over-engineered System in the IDF – Created by Bijoy Gajjar (Gen AI)

Consider the scenario where over-dimensioned RAN sources are placed in an inaccessible Intermediate Distribution Frame (IDF) or Headend; resolving such issues could take days or weeks, leaving the system flagged as a top offender.

As systems become increasingly digitized, fiber and Cat6 solutions will evolve accordingly, which could shift revenue for passive equipment markets as digital alternatives take center stage.

WiFi, Cellular DAS and Small Cells RAN: Coexisting in Harmony?

WiFi, Cellular DAS and Small Cells RAN: Coexisting in HarmonyThe Common Public Radio Interface (CPRI) and Open RAN Interface Split 7.2x are key to achieving interoperability between Distributed Units (DUs) and Radio Units (RUs) in Open RAN, driving power, space, and cost efficiencies for

sustainable solutions in inbuilding public venues and enterprises. The strategy of Tier 1 MNOs will have a major impact on the market for specific in-building solutions.

WiFi, Cellular DAS, and Small Cells may offer distinct TCOs and use cases, complementing each other to maintain a hybrid ecosystem. Future strategies for these solutions will evolve over time.

Would WiFi, DAS, Small Cells Coexist? – Created by Bijoy Gajjar (Gen AI)

In summary, decision-makers considering ORAN indoor upgrades may focus on factors such as ownership of physical network assets, funding, technical subject matter expertise for new solutions, management, security and, most importantly, control. Use cases will be the primary driver, with Total Cost of Ownership (TCO) playing a significant role in shaping decisions. In-building solutions present numerous opportunities, especially as many existing enterprise and global public venue systems have reached end-of-life and do not support 5G.

Celltene LLC Author’s Disclaimer:

My expertise includes Wireless Technology, RF Engineering, Systems Architecture, large project management, program management, strategy, proof-of-concepts, FOAs, and cost efficiencies. I have conducted interoperability testing for 4G/5G Nokia and Ericsson RAN systems, designed enterprise solutions with Ericsson Dot/DRAN and Nokia RAN products for FR1 and FR2 spectrum, and led national strategic initiatives for high-profile venues like Airports, Train Stations, Stadiums, Arenas, Casinos, Malls, Airports and Convention Centers. I also mentored over 50 cross-functional SMEs as National Inbuilding Lead, with notable recent success including the Globe Life Field Performance Enhancement project for the 2024 MLB All-Star Week.

I am passionate about Public Venue Technology Evolution, Private Network Solutions Engineering, and Satellite Engineering Projects like SpaceX, AST SpaceMobile, Amazon Kuiper, which aim to connect underserved populations. With over 18 years in the telecom industry, I have led global, cross-functional teams and managed over 45 personnel

for optimal efficiency and large project success, benefiting North American MNOs and various business sectors. I have traveled extensively across 40+ states in North America, contributing to seamless wireless connectivity solutions.

Positive Approach:

With cumulative experience in Small Cell/DAS, network engineering, WiFi, outdoor macro, and in-building solutions, I bring insights to this article. I welcome feedback and criticism on the article. I am open to making changes based on your suggestions. Your input is valuable to me, and I take a constructive approach to criticism. Please feel free to reach out to me directly if you feel that something is not aligned or could be improved.

Acronyms:

• 3GPP – 3rd Generation Partnership Project

• 5G – Fifth Generation of Mobile Networks

• AI – Artificial Intelligence

• CAPEX – Capital Expenditure

• DAS – Distributed Antenna System`

• DDoS – Distributed Denial of Service

• FCC – Federal Communications Commission

• FR1 & FR2 – Frequency Range 1 & Frequency Range 2

• GA – General Availability

• HW – Hardware

• ML – Machine Learning

• MNO – Mobile Network Operator

• MOCN – Multi-Operator Core Network

• MORAN – Multi-Operator Radio Access Network

• NB-IoT – Narrowband Internet of Things

• O-CU – Open Central Unit

• O-DU – Open Distributed Unit

• O-RIC – Open RAN Intelligent Controller

• O-RU – Open Radio Unit

• OEM – Original Equipment Manufacturer

• OPEX – Operational Expenditure

• ORAN – Open Radio Access Network (Open RAN)

• OSI – Open Systems Interconnection

• OSS – Operations Support System

• PoC – Proof of Concept

• RAN – Radio Access Network

• SW – Software

• TCO – Total Cost of Ownership

• TCP/IP – Transmission Control Protocol/Internet Protocol

• U. S. – United States